Many countries are beginning to double down on cryptocurrency mining by imposing heavy taxes or an outright ban. China has a blanket ban on crypto mining, while others have to amend existing regulations by slamming heavy levies on miners.

However, the energy demand of crypto mining is not in doubt, and countries want to ensure the efficient use of energy to meet domestic and industrial use.

The Republic of Kazakhstan is the latest to impose a heavy tax on crypto miners. Kassym-Jomart Tokayev’s president has assented to the country’s amended tax code for the crypto industry.

However, the new tax depends on the amount and price of energy used in cryptocurrency mining.

Crypto Miners Brace for More Levies

The new legislation signed by Tokayev will introduce changes to the nation’s tax laws and enhance the effectiveness of its tax code. For the cryptocurrency industry, the new regulations have a different tax rate for all mining categories.

The amount of tax miners are expected to pay to the government is determined by the amount of electricity used in minting crypto-assets during a specific tax period.

For emphasis, the starting rate is 1 Tenge, which is approximately $0.002 per kilowatt-hour. The price changes depending on the duration of mining and energy consumed during that period.

Meanwhile, crypto mining farms using energy from renewable sources will pay the lowest price regardless of the mining duration. Following China’s crackdown on miners and their subsequent foray into Kazakhstan

The country experienced a steady energy deficit last year, prompting calls for strict regulatory enforcement.

Tax Law will Lessen the Burden on Power Grid

The Central Asian nation has also attempted to limit crypto mining through the imposition of electricity supply during winter. It has also shut down some mining farms across the country, forcing miners to move equipment to other friendly countries.

President Tokayev directed authorities in February to identify cryptocurrency miners working within the country’s territory and increase their taxes.

The country’s auditors have had to clamp down on mining firms that exploited tax benefits they were otherwise not eligible for.

The government has earlier proposed that the new tax rate be tied to the value of the minted digital asset to discourage dependence on electricity from the national grid.

According to an insider report, the new tax rate is designed to free the national grid from some unnecessary load brought by crypto mining. And to achieve this, the tax rate is tied to the value of the minted token.

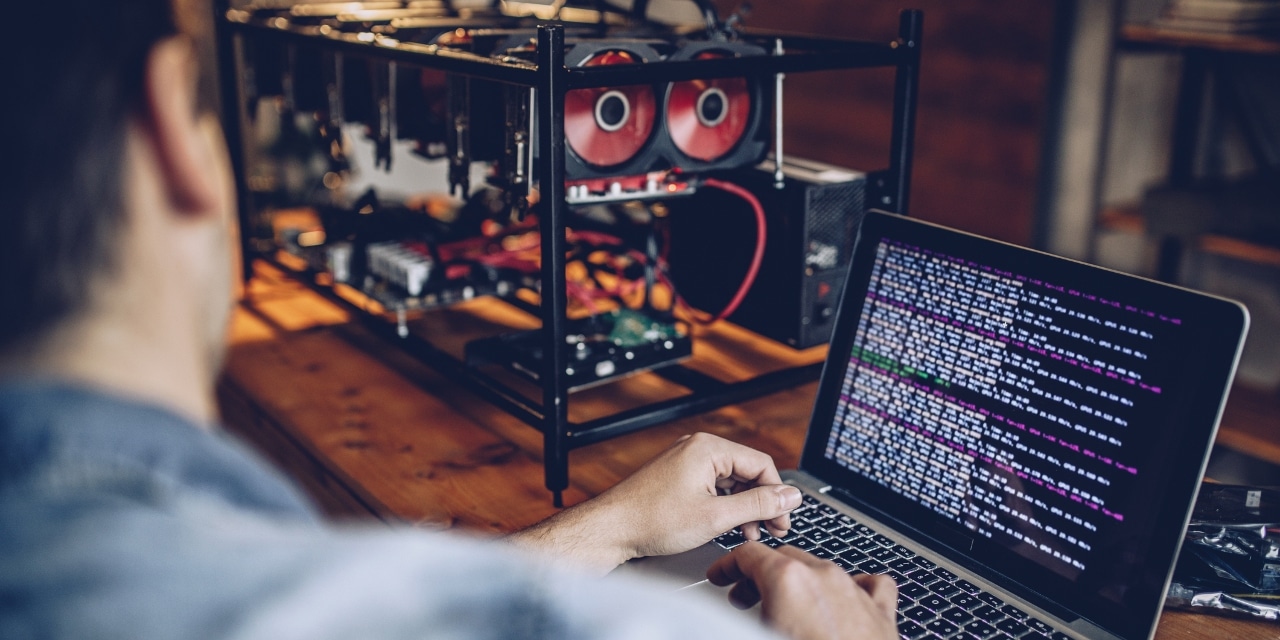

Crypto mining is an energy-intensive operation that governments worldwide have taken an interest in overseeing. Additionally, there have been increased calls by environmental activists for governments to ban crypto mining, especially the Proof-of-Work (PoW) consensus.

Many view the PoS protocol as having an environmental impact and have clamored for its ban to be replaced by a more energy-efficient model.

Meanwhile, renewable energy sources are identified as the best possible ways to mine crypto-assets, but miners prefer non-renewable ones.