Compound Finance Review

The Crypto industry has continued to provide innovations and technological developments across platforms. Thanks to finance protocols and new finance infrastructures emerging in the cryptocurrency industry, the roles of traditional banking institutions are being altered daily. One such offer is Compound Finance, and this is a review of their services.

Banks Offer very menial interest rates, while making tons of profit using the deposits made by their customers. This trend is slowly being altered with the advent of decentralized finance protocols in the crypto industry.

Depositors in these traditional banks can easily turn to lenders due to the financial protocols built on several crypto blockchains, the most popular being the Ethereum blockchain. When depositors turn to lenders, they effectively remove the middlemen role played by the traditional banks.

This action effectively gives the bank depositors, now lenders, the full benefits of their funds rather than getting shortchanged by the banks.

Compound Finance is a crypto protocol that plays the role of banks, but users make a full profit from their funds and the compound protocol takes gains from a fee paid.

Crypto enthusiasts are very riled up from the opportunities presented by Compound Finance and the platform’s services. This is in addition to the fact that crypto was built and developed, in the first place, as an envisioned better alternative to the over-centralized systems that run and control financial and economic systems in the world.

Compound Finance provides these services in full trust; this is another attractive lure to many crypto players and market participants.

| Exchange platform | Compound Finance |

| Website | app.compound.finance |

| Variety crypto | 18 |

| Account needed | NO |

| Verification | No Verification Needed |

| Verification levels | None |

| Trading Platform | Web-based app |

| Payment Method | Ethereum Wallet |

| Customer Support | Discord, Medium, Twitter, Github |

What is Compound Finance?

In simple terms, Compound Finance is a web-based decentralized finance platform, for lending and borrowing money. Compound Finance has earned itself a savings account, run in a decentralized finance manner in the cryptocurrencies industry.

Since the advent of decentralized finance, Compound Finance has been a go-to place for people wishing to use their crypto assets to make gains. The finance platform runs a decentralized finance protocol, enabling users to lend their crypto assets out while users who wish to borrow cryptos borrow the cryptos of their choice.

The lenders supply liquidity to the marketplace. At the same time, the borrowers take up the demand side of the marketplace by borrowing from the available 18 market assets on the Compound Finance liquidity market platform.

Compound Finance, as a decentralized platform, is built on the Ethereum network blockchain and supports the lending and borrowing of Ethereum ERc-20 tokens. The Compound Finance team looks to increase the number of markets and assets borrowable on its platform. This means that potential lenders would have more opportunities to make money on the Compound Finance decentralized finance protocol.

Compound Finance completely takes out the third-party bridge of the banks in the transactions that occur on the protocol. This is achieved during the lending and borrowing of assets: the lenders, who are the suppliers of liquidity, and the borrowers do not get to meet to negotiate the terms of the transaction.

This borrowing or lending is done completely via the protocol, as that is how both parties interact. The liquidity sought by the borrower is held in a liquidity pool by smart contracts; once the borrower meets the required collateral terms and other requirements, the asset is released to them.

The smart contracts handle the collateral and interest rate negotiations that occur on the Compound Finance protocol; hence the transacting parties do not make negotiations as in traditional settings.

Borrowers on the Compound Finance protocol need to supply more value than they wish to borrow in a concept of over-collateralization. This is done to ensure that borrowers can cover the cost of the assets they wish to borrow. This is so that, in a situation that they do not pay back their borrowed asset within the required time, the lender would liquidate their collateral asset to cover the value of the borrowed asset.

Compound Finance has an ecosystem token called COMP. A user of the compound finale protocol has their assets converted to CTOKENS either for lending or borrowing. That is because that is the monetary form through which lending and borrowing are carried out.

Borrowers on the Compound Finance protocol, after depositing the funds which would serve as their collateral and interacting with the protocol, would have to earn borrowing power that would determine the amount of the asset they can borrow with their available collateral.

Compound Finance has a governance system, through which holders of the native token of the ecosystem bite on happenings in the protocol. Most voting is done on these: ctoken markets to list, interest rates/required assets for over collaboration, improvement proposals, etc.

Compound Finance Trading services

Compound Finance has a major lending and borrowing service in addition to its leading trading services. The Compound Finance protocol works while allowing users who wish to explore it to do so. Users interested will have to visit the protocol’s web-based app. At this point, they can connect their WEB 3.0 supported wallet, such as Metamask, with an extension for the Ethereum network blockchain.

Other wallets that support Web 3.0 and the Ethereum network can also be used. After the connection, you can interact with the finance protocol by unlocking whichever pool you wish to work with.

If you wish to be a lender, that is pretty easy; you just need to unlock the asset you wish to supply into the liquidity pool you have unlocked. Your earnings are according to your share of the pool you have supplied liquidity and the interest rate of the token as determined by the smart contract.

You begin to earn in real-time immediately; your supplied token is converted into a cTOKEN of the asset you supplied. For instance, if you supply ETH, your token would become cETH or cDAI or cSUSHI, as the case may be.

Lenders and borrowers can redeem their ctokens on the Compound Finance protocol platform depending on the portion of the pools the cTOKENS represent. This redemption of the cTOKEN makes the assets available to the connected wallets.

The more the liquidity market of the Compound Finance protocol earns interest, the more money would be available for borrowing to borrowers.

The more cTOKENS earn interest, the more they are converted to their underlying assets on the Compound Finance protocol.

This is how the savings account model works to produce money for the lenders. To make money normally on Compound Finance, you need to hold and lend ERC-20 tokens to continually earn interest.

The Compound Finance protocol currently supports 18 assets in its lending and borrowing markets; as of 5/8/2021, the assets include:

- USDC – USD coin

- DAI – Dai

- ETH – Ethereum

- WBTC – Wrapped BTC

- UIN – Uniswap

- USDT – Tether

- COMP – Compound Governance Token

- TUSD – TrueUSD

- ZRX – Ox

- WBTC – Wrapped BTC (legacy)

- LINK – ChainLink Toke

- BAT – Basic Attention Token

- SAI – Sai (Deprecated)

- REP – Augurv1 (Deprecated)

- AAVE – Aave Token

- MKR – Maker

- YFI – Yearn. finance

- SUSHI – Sushi Toke

The Compound Finance team will, most likely, add more assets in the future as they continue to grow.

Compound Finance Fees

The Compound Finance protocol lending and borrowing platform does not run on standard fee structures as centralized exchange platforms do. The protocol fees are determined by the activities on the Ethereum blockchain. This fee structure model makes it compulsory that users need to have some extra funds in their wallets when connecting to the protocol to use for paying transactions gas fees.

The gas fees paid on the Compound Finance protocol platform can be very high. This is usually attributed to the high volume of transactions carried out on the Ethereum network blockchain.

These high gas fees are usually a source of concern to the users of the Compound Finance protocol. The high gas fees would become a thing of the past with the ETH 2.0 main network upgrade’s anticipated coming.

The fees paid on the Compound Finance protocol are paid by lenders, who are the suppliers, when they sign and approve transactions from their wallets connected to the protocol.

The borrowers on the protocol also pay gas fees when they deposit their collateral funds to Compound Finance.

Compound Finance Withdrawal and Deposit Fees

There are no standard withdrawal and deposit fees paid by users on the Compound Finance protocol. The fees paid are dependent on the volumes of transactions and the transaction levels on the Ethereum network blockchain.

When there are high transaction volumes at any given time on the Ethereum network blockchain, the transactions on the Compound Finance protocol would cost high gas fees.

When the transaction volumes on the Ethereum blockchain are low, then, the transactions on the Compound Finance protocol would cost lower gas fees.

With these established, the deposit and withdrawal fees paid on the Compound Finance protocol are determined by the volumes of transactions carried out on the Ethereum network.

The current fee structure used by the Compound Finance protocol is in place because the protocol is a decentralized one built on the Ethereum network blockchain system.

Compound Finance API

The Compound Finance protocol has a robust API that allows users and developers to integrate into the functionalities of the Compound Finance lending and borrowing platform.

Compound Finance stands as a decentralized lending and borrowing platform hence their robust API integration functionalities.

Compound Finance protocol has a dedicated web page on its API functionalities, for people who covet and wish to understand the advantage of accessing and utilizing the immense options in the protocol.

The Compound Finance API offers users access to every aspect of the platform, using the protocol Buffers, known colloquially as Protobufs. The protocol Buffers of the Compound Finance platform are unlike every other protocol buffer. This is because the API endpoints of Compound Finance support JSON for both input and output requests.

The API endpoint of Compound Finance also specifies headers of “Content-Type: application/JSON” and “Accept application/JSON” in the API request.

According to the Compound Finance team, API access to Compound Finance does not require keys currently, but may require keys in the future.

Compound Finance has these major API access:

- AccountServices

- CTokenService

- MarketHistoryService

- GovernanceService

Compound Finance Limits and Liquidity

The Compound Finance protocol has an enormous availability of liquidity on its platform. This applies to both the supply side from lenders and the demand side from borrowers. The Compound Finance protocol currently has over $16.5 billion worth of assets on the total market supply, with 294544 suppliers of liquidity.

The current borrowed amount on the Compound Finance protocol is over $7 billion, with 897 borrowers.

Comparing the number of borrowers to the number of suppliers in the protocol, you would understand that Compound Finance has excess liquidity and more to spare.

Compound Finance protocol has no limit whatsoever on the amount of liquidity supply you can give to the protocol as a liquidity supplier. For borrowers, the only limit applied is dependent on your collateral. If you wish to borrow from the Compound Finance protocol platform, your borrowing limit is corrected to your collateral.

Compound Finance Portfolios

The Compound Finance protocol has large portfolios as a decentralized platform. Users of the platform have the opportunity to diversify their portfolios into the different 18 markets available on the platform.

Suppliers of liquidity mostly have a great chance of cashing in on the diversified tokens on the Compound Finance protocol. This is possible as users can decide to supply liquidity to all the liquidity pools on the platform, thereby earning interests on the ctokens that would be derived as interest on the various pools.

You can say the same thing of the borrowers as they can borrow on several assets if they have a large portfolio of assets to use as collateral.

Cryptocurrencies Available on Compound Finance

Compound Finance protocol has a total of 18 cryptocurrencies supported on its decentralized lending and borrowing platform. These cryptocurrencies are all compatible and transactive on the Ethereum network blockchain. This is essential as the Compound Finance protocol is built on the Ethereum blockchain infrastructure. The supported cryptocurrencies on the platform include:

- USDC – USD coin

- DAI – Dai

- ETH – Ethereum

- WBTC – Wrapped BTC

- UIN – Uniswap

- USDT – Tether

- COMP – Compound Governance Token

- TUSD – TrueUSD

- ZRX – Ox

- WBTC – Wrapped BTC (legacy)

- LINK – ChainLink Toke

- BAT – Basic Attention Token

- SAI – Sai (Deprecated)

- REP – Augurv1 (Deprecated)

- AAVE – Aave Token

- MKR – Maker

- YFI – Yearn. finance

- SUSHI – Sushi Toke

The above listed are currently the supported cryptocurrencies on the Compound Finance protocol platform. From information given by the Compound Finance team, they will add many more in the near future.

Compound Finance Interface

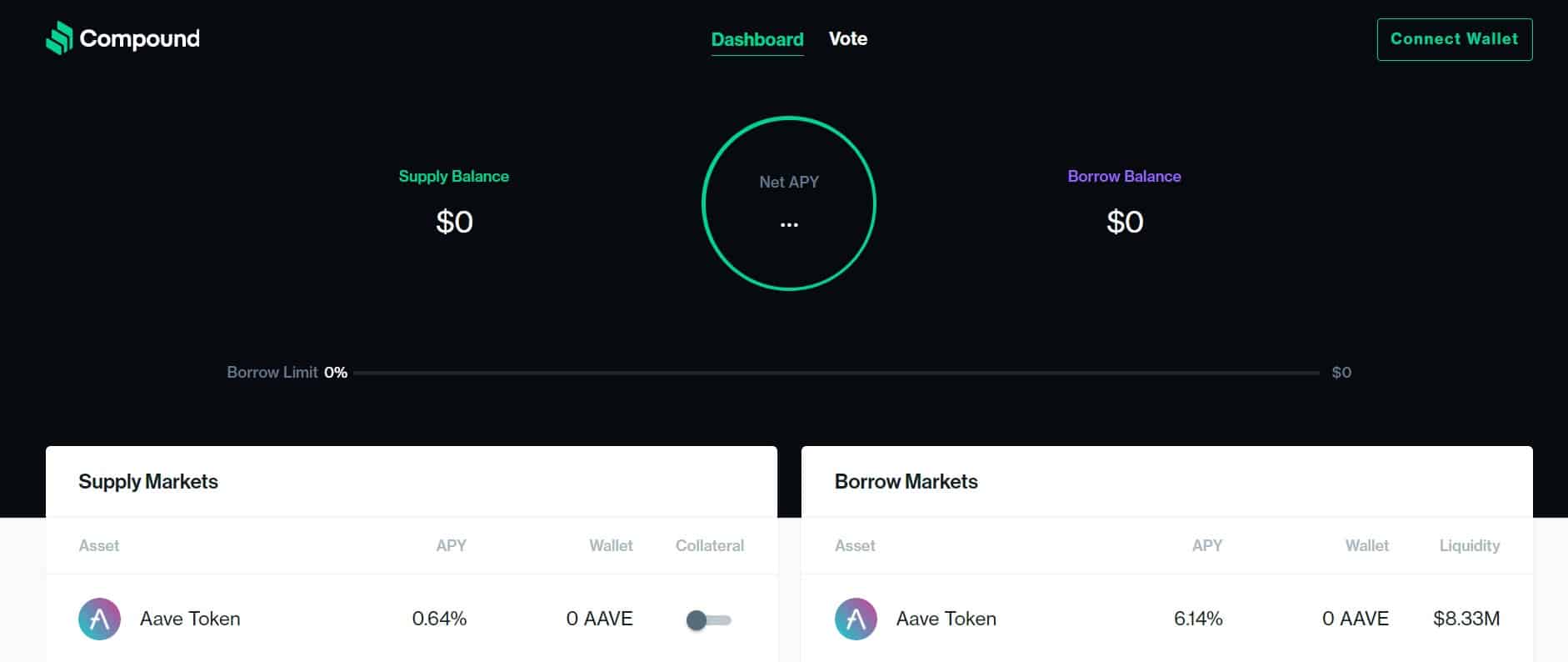

The Compound Finance interface is user-friendly, easy to use, and very interactive with users and developers who would like to use the platform’s robust API.

The Compound Finance interface is straightforward to use. For anyone who visits the website at Compound Finance, the interface displays the supply market on the landing page when you visit the website. They did this intentionally to help you earn, as the suppliers are the better earners from the Compound Finance protocol.

How secure is Compound Finance?

Compound Finance is highly secured as a decentralized platform on the Ethereum blockchain. The platform’s smart contract has been audited, and a verifier for security by reputable firms in the industry contract has also been added (Open Zeppelin and Trail of Bits). The smart contract has also been audited for bugs by Certosa.

Compound Finance Customer Support

Compound Finance has several customer support channels on social media platforms. The Compound Finance customer support on medium and Twitter would get you a faster response on your issues and challenges. You can reach out to the Compound Finance customer support on these channels:

- Medium

To reach out to Compound Finance customer support on medium, you can make use of medium.com/compound-finance. The channel also doubles as a blog site offering the latest tips, advice, and trends to their services.

To reach out to the customer support of Compound Finance on Twitter, you can use Twitter.com/compoundfinance. Their Twitter account can be followed for the latest news and reports on the events and promos they have.

Conclusion

If you wish to make passive income from your cryptocurrencies, then Compound Finance is your go-to place. You just need to become a supplier of liquidity in the finance protocol of Compound Finance.

Compound Finance over the years has grown to become a major player in the decentralized finance space, with the current number of assets supported on the platform.

Compound Finance, over time, would become completely run by the community through its governance program, in which holders of COMP, the governance token, will run the platform by voting.

Compound Finance Exchange Summary

-

Overall Rating

Summary

Here at The Next Bitcoin you can learn about many trading platforms, one of them is Compound Finance, we have concluded that Compound Finance is a good trading platform, it is NOT a scam! Read our Compound Finance review today and learn all you need to know about the Compound Finance trading platform and why we recommend it for all traders.