Tether is moving to hit $10 billion in market cap, the crypto data analytics firm claims. The third-largest cryptocurrency by market cap will touch its new all-time high market cap soon, making things impossible for Ripple to attain third-ranking again.

XTRgate Review

Trade Multiple Cryptocurrencies With Confidence

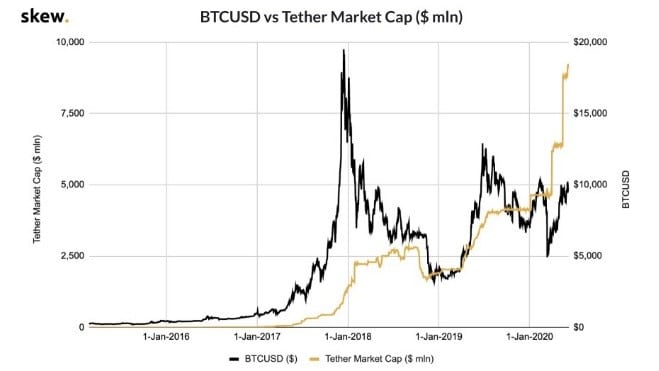

In its latest insight about Tether, crypto analytical company Skew says that “USDT market cap is marching towards $10bln.” It will be USDT’s next achievement after replacing the XRP and taking the third position by market cap.

Source: @skewdotcom

The chart shared by Skew unveils that Tether started to rise from December 2017, when bitcoin topped its ATH of $20,000. Before December 2017, the market cap of Tether was standing nearly $2.5 billion.

Since January 2020, USDT’s market capitalization has significantly increased and the minting ratio of tokens has also surged exponentially since then. But now, the largest stablecoin, USDT, is approaching $10 billion after replacing XRP.

Due to the high demand in the crypto markets, the company is issuing more and more coins. Whale Alert reports that “20,000,000 #USDT (19,944,773 USD) transferred from unknown wallet to #Huobi”.

Today, @glassnodealerts notices that median transaction volume surges significantly in the past 24-hours. “$USDT Median Transaction Volume (2d MA) increased significantly in the last 24 hours…Current value is 238.084 USDT (up 145.0% from 97.169 USDT), “Glassnode Alerts added.

Reason Behind $5 Billion Tether Minting in the Last Six Months

In his latest interview, Paolo Ardoino, the CTO of Tether, explains the reason why they have minted $5 billion in the last six months. While speaking on the podcast “On The Brink With Castle Island,” Ardoino claims that demand has been increasing due to exchanges as USDT is an immediate cash gateway:

“On 12 and 13 of March, when there was that huge drop—50 percent in Bitcoin and other major currencies—we have seen people being stuck on fiat on-ramp exchanges because they couldn’t move fast enough their dollars in order to exploit the market conditions or protect themselves.”

“I believe that Tether is absorbing part of the cash wealth that is sitting in cash in bank accounts on many other exchanges,” he added.